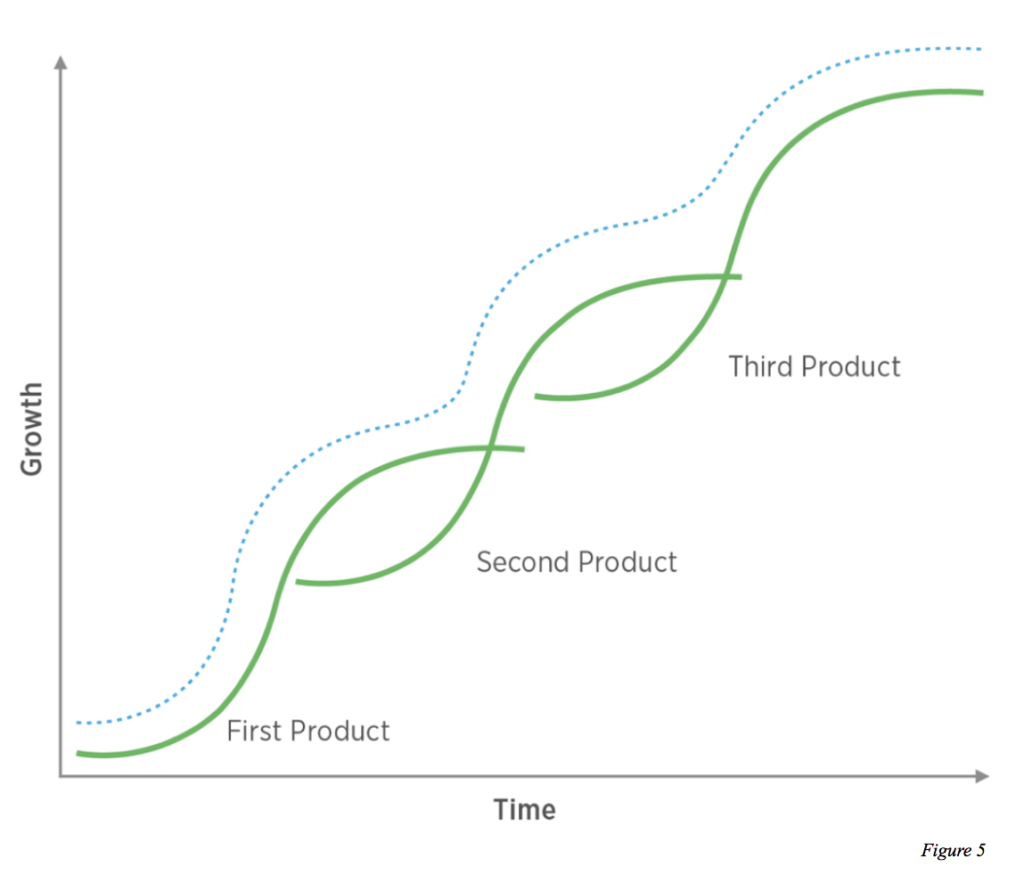

The sage thinker Benedict Evans notably observed: “A technology often produces its best results just when it’s ready to be replaced – it’s the best it’s ever been, but it’s also the best it could ever be.” Right at the point of obsolescence. The Cutty Sark was the best high-speed long-distance sailing freight-carrier – and was as good as commercial sailing ships could ever be. But it came around right when steam ships were about to replace it. The reasoning goes that the S-curve of innovation is a stacking model. The top of the S in one cycle marks the start of the S in the new technology set to replace the incumbent.

The stacking S-curve has now hit the industry driving the pace of tech innovation: venture capital.

In the venture business, convention has got us to the point where there are clear parameters around the make-up of a venture fund. In Australia, this is typically an ESVCLP structure, often with a side unit-trust for flexibility, with a ten year horizon plus a two year extension option. Fees are at 2% p/a of committed capital with a 20% carry rate once the hurdle of 8% compounding has been achieved. In shorthand form, it’s casually expressed as: “We’re an ESVCLP, 10+2, 2 & 20 with an 8% hurdle and accelerated catch-up”. Perfectly simple, for some at least.

The venture model has evolved to the point that this structure is clear, and uncontentious. And while there’s always subtle differences in fund set-ups, the model works for limited partners (LPs) who provide the capital, and in many ways it’s the best it could be.

And yet, it’s now obsolete. As Evans says, the best is last.

It’s with this observation in mind that we look at Sequoia Capital’s recent announcement that they will be ditching the traditional 10+2 fund life model for an ever-green fund: “Once upon a time the 10-year fund cycle made sense. But the assumptions it’s based on no longer hold true… The best founders want to make a lasting impact in the world. Their ambition isn’t confined to a 10-year period. Neither is ours.”

And so Sequoia is set to establish an open-ended, liquid portfolio top-fund that will take their LP’s capital. It will then deploy it into a series of sub-funds targeting various investment profiles. Sequoia will cease working to a ten year timeframe on their deals, as exits will flow up to the top-fund and then down again to the sub-funds in a perpetual process (or so the LPs hope).

Couple this change from the industry heavyweight Sequoia with the establishment, at the other end of the spectrum, of the rolling fund, pioneered by AngelList, and it’s clear the ten year fund horizon is now a thing of the past.

My prediction is that in the near future, venture capital funds will now be either structured as ‘rolling’ or ‘evergreen’.

This will benefit founders as it removes an artificial driver to early liquidity. And in allowing great investments to run long and deep into the value accretion stages of growth, investors will benefit significantly also.

When we set-up Shearwater in 2018, we saw the attractiveness of evergreen capital for founders, and us as investors. So we’re in the evergreen camp. We have no fund horizon, allowing founders the time to build great businesses for ten years, and beyond.